The papers are filled with pictures of Obama and Hu. I can't help but see this as a a ceremony of succession, as China prepares to take over as the dominant empire. Which makes Greer' article on collapsing empires quite timely!

I’ve commented more than once in these essays on the gap in perception between history as it appears in textbooks and history as it’s lived by people on the spot at the time. That’s a gap worth watching, because the foreshortening of history that comes with living in the middle of it quite often gets in the way of figuring out a useful response to a time of crisis – for example, the one we’re in right now.

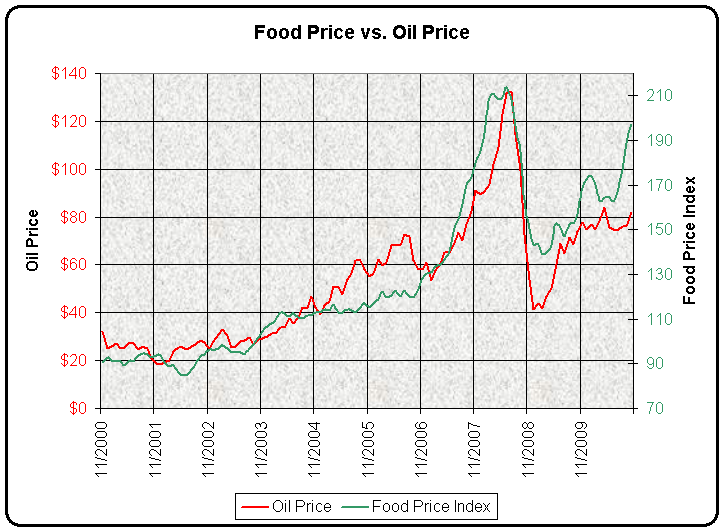

This is all the more challenging because the foreshortening of history cuts both ways; it makes small but sudden events look more important than they are, and it also helps hide slow but massive shifts that will play a much greater role in shaping the future. Recent increases in the price of oil, for example, kicked off a flurry of predictions suggesting that hyperinflation and the sudden collapse of industrial society are right around the corner; identical predictions were made the last time oil prices spiked, the time before that, and the time before that, too, so the traditional grain of salt may be worth adding to them this time around. (We’ll most likely get hyperinflation in the US, granted, but my guess is that that will come further down the road.) Look at all these price spikes and notice that the peaks and troughs have both tended gradually upwards, on the other hand, and you may just catch sight of the signal hidden in all that noise – the fact that providing industrial civilization with its most important fuel is loading a greater burden on the world’s economies with every year that passes.

The same gap in perception afflicts most current efforts to make sense of the future looming up ahead of us. Ever since

my original paper on catabolic collapsefirst found its way onto the internet, I’ve fielded questions fairly regularly from people who want to know whether I think some current or imminent crisis will tip industrial society over into catabolic collapse in some unmistakably catastrophic way. It’s a fair question, but it’s based on a fundamental misreading both of the concept of catabolic collapse and of our present place in the long cycles of rise and fall that define the history of civilizations.

Let’s start with some basics, for the sake of those of my readers who haven’t waded their way through the fine print of the paper. The central idea of catabolic collapse is that human societies pretty consistently tend to produce more stuff than they can afford to maintain. What we are pleased to call “primitive societies” – that is, societies that are well enough adapted to their environments that they get by comfortably without huge masses of cumbersome and expensive infrastructure – usually do so in a fairly small way, and very often evolve traditional ways of getting rid of excess goods at regular intervals so that the cost of maintaining it doesn’t become a burden. As societies expand and start to depend on complex infrastructure to support the daily activities of their inhabitants, though, it becomes harder and less popular to do this, and so the maintenance needs of the infrastructure and the rest of the society’s stuff gradually build up until they reach a level that can’t be covered by the resources on hand.

It’s what happens next that’s crucial to the theory. The only reliable way to solve a crisis that’s caused by rising maintenance costs is to cut those costs, and the most effective way of cutting maintenance needs is to tip some fraction of the stuff that would otherwise have to be maintained into the nearest available dumpster. That’s rarely popular, and many complex societies resist it as long as they possibly can, but once it happens the usual result is at least a temporary resolution of the crisis. Now of course the normal human response to the end of a crisis is the resumption of business as usual, which in the case of a complex society generally amounts to amassing more stuff. Thus the normal rhythm of history in complex societies cycles back and forth between building up, or anabolism, and breaking down, or catabolism. Societies that have been around a while – China comes to mind – have cycled up and down through this process dozens of times, with periods of prosperity and major infrastructure projects alternating with periods of impoverishment and infrastructure breakdown.

A more dramatic version of the same process happens when a society is meeting its maintenance costs with nonrenewable resources. If the resource is abundant enough – for example, the income from a global empire, or half a billion years of ancient sunlight stored underground in the form of fossil fuels – and the rate at which it’s extracted can be increased over time, at least for a while, a society can heap up unimaginable amounts of stuff without worrying about the maintenance costs. The problem, of course, is that neither imperial expansion nor fossil fuel drawdown can keep on going indefinitely on a finite planet. Sooner or later you run into the limits of growth; at that point the costs of keeping wealth flowing in from your empire or your oil fields begin a ragged but unstoppable increase, while the return on that investment begins an equally ragged and equally unstoppable decline; the gap between your maintenance needs and available resources spins out of control, until your society no longer has enough resources on hand even to provide for its own survival, and it goes under.

That’s catabolic collapse. It’s not quite as straightforward as it sounds, because each burst of catabolism on the way down does lower maintenance costs significantly, and can also free up resources for other uses. The usual result is the stairstep sequence of decline that’s traced by the history of so many declining civilizations—half a century of crisis and disintegration, say, followed by several decades of relative stability and partial recovery, and then a return to crisis; rinse and repeat, and you’ve got the process that turned the Forum of imperial Rome into an early medieval sheep pasture.

It’s easy enough to track catabolic collapse at work in retrospect, when you can glance over a couple of centuries of decline in an evening with one of Michael Grant’s excellent histories of Rome in one hand and a glass of decent bourbon in the other. Catching it in process, though, can be a much more challenging task, because it happens on a scale considerably larger than a human lifespan. In its early stages, the signal is hard to tease out from ordinary economic and political fluctuations; later on, it’s all too easy to believe that any given period of stabilization has solved the problem, at least until the next wave of crises rolls in; late in the game, as crisis piles on top of crisis and cracks are opening up everywhere, your society’s glory days are so far in the past that it’s surprisingly easy to lose track of the fact that calamity isn’t the normal shape of things.

Still, the attempt is worth making, and I propose to make it here. In fact, I’d like to suggest that it’s possible at this point to provide a fairly exact date for the onset of catabolic collapse here in the United States of America.

That America is a prime candidate for catabolic collapse seems tolerably clear at this point, though I’m sure plenty of people can find reasons to argue with that assessment. It’s considered impolite to talk about America’s empire nowadays, but the US troops currently garrisoned in 140 countries around the world are not there for their health, after all, and it requires a breathtaking suspension of disbelief to insist that this global military presence has nothing to do with the fact that the 5% of our species that live in this country use around a quarter of the world’s total energy production and around a third of its raw materials and industrial products. The United States has an empire, then, and it’s become an extraordinarily expensive empire to maintain; the fact that the US spends as much money on its military annually as all the other nations on Earth put together is only one measure of the maintenance cost involved.

That America is also irrevocably committed to dependence on dwindling supplies nonrenewable fossil fuels also seems clear at this point, though here again there are plenty who would dispute the point. Even if there were other energy resources available in the same gargantuan amounts – and despite decades of enthusiastic claims, every attempt to deploy other energy resources to replace a significant amount of fossil fuels has run headfirst into crippling problems of scale – the political will to carry out a transition soon enough to matter has not been present, and the careful analyses in the 2005 Hirsch report are among the many good reasons for thinking that the window of opportunity for that transition is long past. The notion that America can drill its way out of crisis would be funny if the situation was not so serious; despite dizzyingly huge government subsidies and the best oil exploration and extraction technology on Earth, US oil production has been in decline since 1972. As the first nation to develop a commercial petroleum industry, it was probably inevitable that we would be among the very first to hit the limits to production and begin slipping down the arc of decline. As for coal and natural gas, the abundance of the former and the glut of the latter are the product of short term factors; while press releases aimed mostly at boosting stock prices insist that we’ll have supplies of both for centuries to come, more sober analysts have gotten past the hype and the hugely inflated reserve figures and predicted hard peaks for both fuels within thirty years, and quite possibly sooner.

That being the case, the question is simply when to place the first wave of catabolism in America – the point at which crises bring a temporary end to business as usual, access to real wealth becomes a much more challenging thing for a large fraction of the population, and significant amounts of the national infrastructure are abandoned or stripped for salvage. It’s not a difficult question to answer, either.

The date in question is 1974.

That was the year when the industrial heartland of the United States, a band of factories that reached from Pennsylvania and upstate New York straight across to Indiana and Michigan, began its abrupt transformation into the Rust Belt. Hundreds of thousands of factory jobs, the bread and butter of America’s then-prosperous working class, went away forever, and state and local governments went into a fiscal tailspin that saw many basic services cut to the bone and beyond. Meanwhile, wild swings in markets for agricultural commodities and fossil fuels, worsened by government policy, pushed most of rural America into a depression from which it has never recovered. In the terms I’ve suggested in this post, the US catabolized most of its heavy industry, most of its family farms, and a good half or so of its working class, among other things. It also set in motion the process of catabolizing one of the most important resources it had left at that time, the oil reserves of the Alaska North Slope. That oil could have been eked out over decades to cushion the transition to a low-energy future; instead, it was pumped and burnt at a breakneck pace in order to deal with the immediate crisis.

The United States was not alone in embracing catabolism in the mid-1970s. Britain abandoned most of its own heavy industry at the same time, plunging large parts of the industrial Midlands and Scotland into permanent depression, and set about catabolizing its own North Sea oil reserves with the same misplaced enthusiasm that American politicians lavished on the North Slope. The result was exactly what history would suggest; by embracing catabolism, the US and Britain both staggered through the crisis years of the 1970s and came out the other side into a breathing space of relative stability in the Reagan and Thatcher years,. That breathing space was extended significantly when the collapse of the Eastern Bloc, beginning in 1989, allowed American and British economic interests and their local surrogates to snap up wealth across Eurasia for pennies on the hundred-dollar bill, in the process imposing the same sort of economic collapse on most of a continent that had previously been inflicted on the steelworkers of Pittsburgh and the shipbuilders of Glasgow.

That breathing space ended in 2008. At this point, I’d suggest, we’re in the early stages of a second and probably more severe round of catabolism here in America, and throughout Europe as well. What happened to the industrial working class in the 1970s is now happening to a very broad swath of the middle class, as jobs evaporate, public services are slashed, and half a dozen states stumble down the slope that will turn them into the Rust Belt equivalents of the early 21st century. Exactly what will happen as that process continues is anybody’s guess, but it’s unlikely to end as soon as the round of catabolism in the 1970s, and it may very well cut deeper; neither we nor Britain nor any other of our close allies has a big new petroleum reserve just waiting to be tapped, after all.

It’s crucial to remember, though, that catabolism is a response to crisis and at least in the short term, much more often than not, an effective response. The fact that we’re moving into the second stage of our society’s long descent into catabolic collapse doesn’t mean that America will fall apart in the next decade or so; quite the contrary, it strongly suggests that America will not fall apart this time around. As the current round of catabolism picks up speed, a great many jobs will go away, and most of them will never return; a great many people who depend on those jobs will descend into poverty, and most of them will never rise back out of it; much of the familiar fabric of life in America as it’s been lived in recent decades will be shredded beyond repair, and new and far less lavish patterns will emerge instead; outside the narrowing circle of the privileged classes, even those who maintain relative affluence will be making do with much less than they or their equivalents do today. All these are ways that a society in decline successfully adapts to the contraction of its economic base and the mismatch between available resources and maintenance costs.

Twenty or thirty or forty years from now, in turn, it’s a fairly safe bet that the years of crisis will come to a close and a newly optimistic America will reassure itself that everything really is all right again. The odds are pretty high that by then it will be, for all practical purposes, a Third World nation, with little more than dim memories remaining from its former empire or its erstwhile status as a superpower; it’s not at all impossible, for that matter, that it will be more than one nation, split asunder along lines traced out by today’s increasingly uncompromising culture wars. Fast forward another few decades, and another round of crises arrives, followed by another respite, and another round of crises, until finally peasant farmers plow their fields in sight of the crumbling ruins of our cities.

That’s the way civilizations end, and that’s the way ours is ending. The phrasing is deliberate: "is ending," not "will end." If I’m right, we’re already half a lifetime into the decline and fall of industrial civilization. It can be challenging to keep that awareness in mind when wrestling with the day to day details of getting by in an ailing, sclerotic nation with a half-failed economy – or, for that matter, when trying out some of the technologies and tricks I’ve been discussing here in recent months. Still, it’s worth making the attempt, because the wider view arguably makes it a bit easier to keep current events in perspective and plan for the future in which we will all, after all, be spending the rest of our lives.

Did you hear anything surprising in Obama's

Did you hear anything surprising in Obama's