Happy Motoring!

He blew his mind out in acr

He didn't notice that the light had changed

-Beatles

Turn and face the strange

ch- ch- changes

David Bowie

Greetings

I've been reading an interesting article America, you have three more years to drive normally. The author notes

"Easy driving remains basic to American lifestyle and social identity. For now, Americans are still managing to drive nearly as much as they did a decade ago. But what happens in a few years, when gasoline prices keep going up as wages remain flat, when drivers bid for the same oil needed to heat homes in New England. Who gets the oil and who gets the blame? Will the loss of mainstream driving ability finally create a political tipping point that could lead us to broadly confront and accept natural limits to growth?

The article does a good job of analyzing the geologic and economic situtaion . Based on that I wonder if perhaps we can break peak oil into three phases..

Phase one (2005-2008) features a steady rise in prices, which brings out more investment, and more oil.

Phase two kicks in when the price gets higher than the economy can afford. (2008) It features price oscillation, and successive recessions. Since 2008 we've gone through two such cycles - from $147 , to $30, then $100, and now $50.

Perhaps phase three starts when we hit peak liquids, perhaps now, or perhaps once the shale oil runs out. 2016-2017? No amount of additional investment brings out any increase in total production. Prices rise.further and the long recession becomes permanent

Here's the general idea of phase three from Tom Whipple. (See also this Ministry of Defence -(UK) Report summarized here

If we step back and acknowledge that the shale oil phenomenon will be over in a couple of years and that oil production is dropping in the rest of the world, then we have to expect that the remainder of the peak oil story will play out shortly. The impact of shrinking global oil production, which has been on hold for nearly a decade, will appear. Prices will go much higher, this time with lowered expectations that more oil will be produced as prices go higher. The great recession, which has never really gone away for most, will return with renewed vigor and all that it implies…All this is telling us that the peak oil crisis we have been watching for the last ten years has not gone away, but is turning out to be a more prolonged event than previous believed. Many do not believe that peak oil is really happening as they read daily of surging oil production and falling oil prices. Rarely do they hear that another shoe has yet to drop and that much worse in terms of oil shortages, higher prices and interrupted economic growth is just ahead. We are sitting in the eye of the peak oil crisis and few recognize it. Five years from now, it should be apparent to all.

Once the shale "retirement party" is over, the decline takes over - and the decline rate for fracked wells is extraordinary. Given that shale is currently 55% of total US production, the decline could be very steep. Here' s a recent projection from Jean Laherre

.

As we see in Figure 4 (above), Laherrere predicts a very rapid drop in tight oil production after 2017, leading also to a fast decline in total oil from the lower 48 states, in contrast to the EIA.

Michael Klare has a nice piece about big oil's broken business model. He notes that the the majors had ten years of gradually rising prices, and naturally thought it would continue. They invested heavily in high cost projects, confident that they would pay off. But these projects need the price to average $80 to $100. While we can expect prices spikes to those prices, what about average prices? Klare notes that

"... the IEA believes that oil prices will only average about $55 per barrel in 2015 and not reach $73 again until 2020. Such figures fall far below what would be needed to justify continued investment in and exploitation of tough-oil options like Canadian tar sands, Arctic oil, and many shale projects. Indeed, the financial press is now full of reports on stalled or cancelled mega-energy projects. Shell, for example, announced in January that it had abandoned plans for a $6.5 billion petrochemical plant in Qatar, citing “the current economic climate prevailing in the energy industry.” At the same time, Chevron shelved its plan to drill in the Arctic waters of the Beaufort Sea, while Norway’s Statoil turned its back on drilling in Greenland."

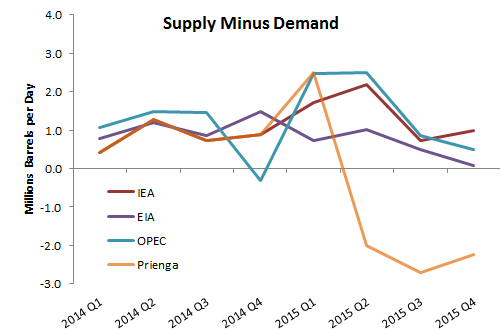

What about the shorter term? Between now and 2017, we might have time for one more price spike and drop. When will the next price spike happen? This depends on how you see supply and demand changing. Kopits thinks that low prices will spur demand, and that production in both unconventional, and conventional areas (but not OPEC) , will decline rapidly. Therefore he sees a spike but this summer.

The Balance

Labels: oil price, Peak Oil, Steven Kopits, Whipple

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home