The revolution

will not be televised

-Gil Scott Heron

Everybody wants to go to heaven

but no one wants to die

-Anon

Greetings

Everybody is watching the price of oil. Is it rising? Or will it go to $20? And what should we wish for? High prices and "energy Independence" or low prices, and the more "driving around and buying stuff"

Its all very confusing. Well we do know, that some extent price and production are related, at least over the longer term. Here,are some nice charts showing how its played out so far.

Here's one teaser:

"The Bank of Canada report reads: “Based on recent estimates of production costs, roughly one-third of current production could be uneconomical if prices stay around US$60, notably high-cost production in the United States, Canada, Brazil and Mexico (Chart 4). More than two-thirds of the expected increase in the world oil supply would similarly be uneconomical.

It's widely assumed that as long as the price stays high enough, the "oil will flow". And the last few years seems to provide some evidence of that thesis. Ron Patterson and the Peak Oil Barrel, (Why We Are at Peak Oil Now) argues to the contrary. He asserts that regardless of price, we have hit the peak of production. While he admits that higher prices will stimulate activity to deliver "unconventional" oil, that the decline rate for the conventional fields will swamp any additional production.

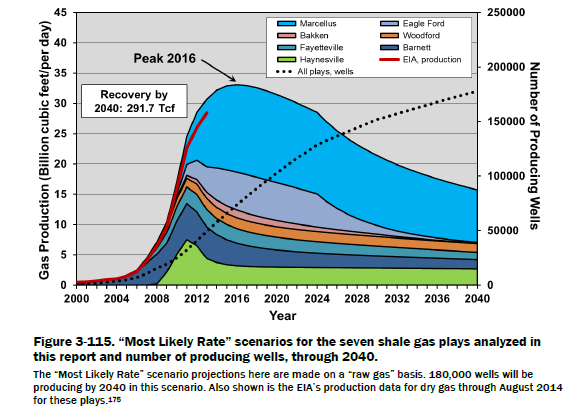

The "shale revolution" is already getting long in the tooth. David Hughes suggest that production will peak by 2016.

And even the Financial Times (US shale oil boom masks declining global supply ), agrees, that with out this production, peak oil is here.

"Based on the preliminary 2014 supply data provided by the US Energy Information Administration in its most recent Short Term Energy Outlook, the total world crude oil supply increased by 3.5m b/d over 2005-14, rising to 77.3m b/d from 73.8m b/d. However, if we strip out the impact of rising production from US shale oil, the global crude oil supply actually declined by around 1m b/d over this period, to 72.6m b/d from 73.5m b/d."

Meanwhile , financial mavens watch the market nervously. Oil companies are now reporting they "value" of their assets, As this article ( Shale Sub Prime and the Ides of March) points out, there are some nervous investors.

"In the so called "junk" bond market alone, rest presently 200 G$ (thousand million dollars) issued by petroleum companies. To this add debt instruments issued in other market segments, bonds issued by industries dependent on petroleum extraction (metallurgy, heavy machinery, sand extraction, logistics), plus leveraged products. In 2008, the "bail out" employed by the US government to save the financial sector from the housing "sub-prime" was 700 G$. The default deluge triggered by the "shale sub-prime" may not seem as large at this moment, but is certainly in the same order of magnitude."

So, what about the "oil shale revolution? In this interview with Chris Martenson Art Berman: explains Why Today’s Shale Era Is The Retirement Party For Oil Production. Quick synopsis: LTO needs to be about $90 bbl to break even. Cheap credit fueled Shale boom. Shale Oil sweet spots identified decades ago. Shale Oil reserves only provides two years of US consumption. There are only about handful of Shale plays that are economical worldwide. Oil prices need to rise back up to about $120 bbl for oil majors to increase CapEx. Dip in Oil prices won’t last.

see also : http://www.artberman.com/

-------

It might be interesting to look at thge situation from the perspective of the Hirsch Report. In that document, Robert Hirsch, suggested that if we had 20 years, we could create a"ramp down" to make the transition to the post peak world less traumatic/ One might say that the "shale revolution" gave us about 10 years. How have we spent those years. Have we beefed up the rail system? Light rail? How about electric cars? Bicycles? How about shoe leather?

Labels: Art Berman, David Hughs, Hirsch, Peak Oil, shale oil

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home