Walk like an Egyptian

Greetings

I recently listend to a new Kunstler cast - a conversation with Dmitri Orlov.. Among other things, they discuss the prospects for Russia and peak oil. Dmitri suggest that Russia has lots of gas and oil, and will be able to do well. At one point they talk about sales to the EU, and Dmiti says something like: "In exchange for what?" Perhaps Russia might not want to sell oil in exchange for Euros.

The periennail problem of hard currency.

Which reminded me of an article I had seen in the New York Times about Egypt. Short of Money Egypt sees Crisis on Food and Fuel. which contained this description of the situation:

"A fuel shortage has helped send food prices soaring. Electricity is blacking out even before the summer. And gas-line gunfights have killed at least five people and wounded dozens over the past two weeks.The root of the crisis, economists say, is that Egypt is running out of the hard currency it needs for fuel imports. The shortage is raising questions about Egypt’s ability to keep importing wheat that is essential to subsidized bread supplies, stirring fears of an economic catastrophe at a time when the government is already struggling to quell violent protests by its political rivals....Diesel fuel is the crux of the crisis, in part because Egypt has a very limited capacity to refine it. Diesel is also essential to much of the economy. Not only do farmers use it to power machinery for irrigation and harvesting, diesel truck fuel contributes to the price of almost everything shipped....Diesel now sells on the thriving black market for more than twice the official subsidized price — though the black market price is still less than $2 a gallon, less than half the price in the United States, reflecting Egypt’s heavy subsidies.Here in the Nile Delta, Ali Mehrous al-Dairy, the patriarch of a farming family, said that even though his four sons waited in line at four different gas stations overnight to fill jerrycans, in the past two weeks they had more frequently all come home empty. Fuel is now hard to come by even on the black market, he said, and black market fuel is often so diluted with water it damages engines.“By God, I don’t know what we are going to do,” he said, looking over motionless irrigation pumps empty of fuel.If diesel is still scarce next month when the harvest begins, “There will be a revolution of the hungry,” said Adbel Moneim Abdel Hady, 40, another wheat farmer.

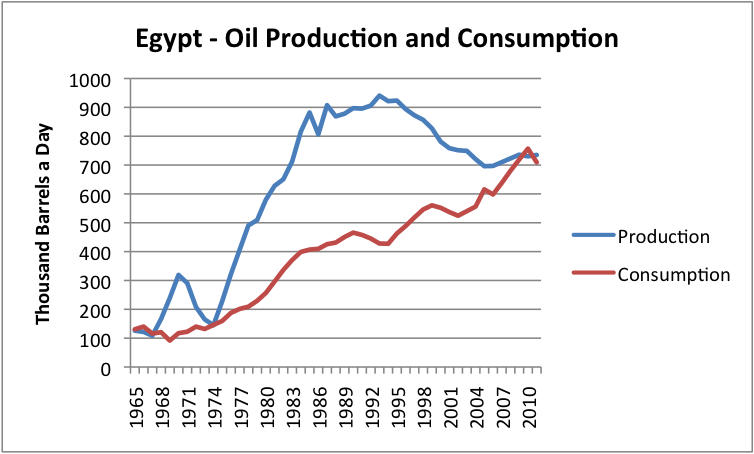

Coincidentally, Gail Tverberg of Our Finite World, had recently put up a post. How Exporters Reach Financial Collapse, which, as it happens, contains an interesting graph dealing with Egypt.

It is interesting to note that the point at which production and consumption meet - the point at which exports cease - was also the point at which the populations of Egypt decided to :throw off its chains"

She explains the dynamic more generally as follows

There are several dynamics at work in the financial collapse of oil exporters:

- Oil exporters are often dependent on oil export revenue to fund government programs.

- The need for government programs grows as population grows and as the price of food rises.

- The amount of oil that can be extracted in a given year often declines over time, as initial stores are depleted.

- Exports often decline even more rapidly than oil supply, because of rising oil consumption as population grows.

Along the same lines. crashwatcher has a new post. (S)he is exploring what would happen if a country, or region, began to hold back oil from the export market. the first case was to hold back enough to continue doing agriculture (which is pegged at 1.1 b/y/person. The second case is ho;lding back 2 b/y/person. Some kind of spooky stuff, but Dennis Meadows statement

("Oil production will be reduced approximately by half in the next 20 years, even with the exploitation of oil sands or shale oil".), gives the need for this modelling some basis.

Labels: crashwatcher, Dennis Meadows, Egypt, Gail Tverberg, Peak Oil

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home